JCRM Technologies

Fraud Detection & Management — Product Specification

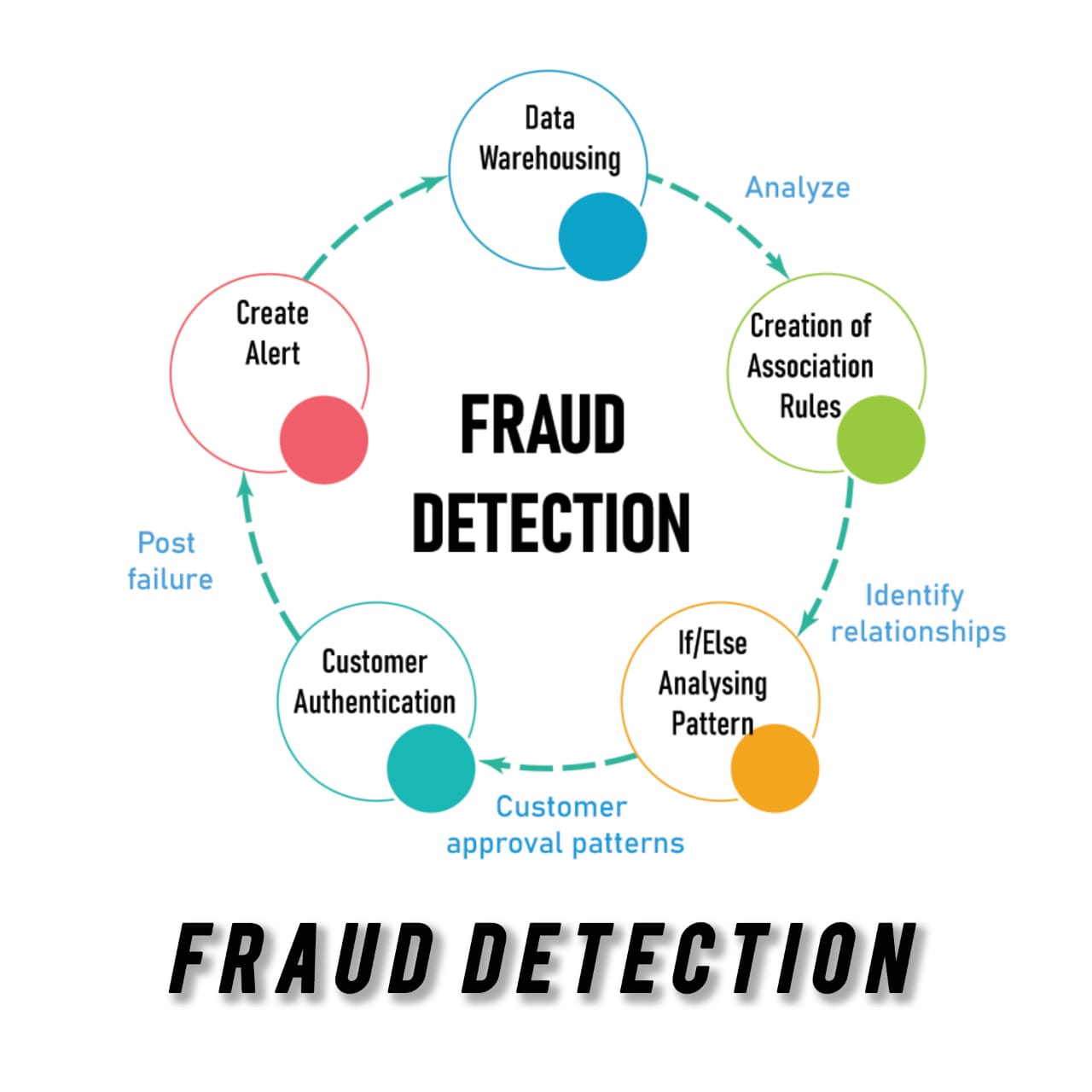

Real-time fraud detection, automated alerts, investigator workflows and model lifecycle management — built to detect, investigate and reduce fraud across payments, accounts and transactions.

Primary Goal

Detect & stop fraud quickly while minimizing false positives and preserving legitimate customer experience.

Deployment

Cloud-native streaming pipelines with low-latency scoring and optional on-prem connectors for sensitive environments.

Core Modules

Comprehensive Feature Set

Modules designed to ingest, score, investigate and report fraud across channels (payments, accounts, KYC, support) with strong governance and ML ops.

1. Data Ingestion & Normalization

- • Stream & batch connectors (Kafka, S3, webhooks, DB CDC)

- • Normalization, enrichment (geo/IP/device), and feature store population

- • PII tokenization, data retention policies and schema registry

2. Real-time Detection & Rules

- • Low-latency rules engine with boolean & scoring rules

- • Support for windowed rules (rolling 24h spikes, velocity checks)

- • Rule versioning, test mode, and staging -> production promotion

3. Machine Learning Scoring

- • Ensemble models: supervised (fraud classifier), unsupervised (anomaly detection)

- • Real-time feature lookup, model explainability (SHAP/LIME)

- • Model drift alerts, A/B testing, and automated retraining pipelines

4. Entity Resolution & Link Analysis

- • Graph database for linking accounts, devices, IPs, emails

- • Visual link explorer with cluster identification

- • Watchlist & blacklist propagation across modules

5. Case Management

- • Alert triage queue with bulk actions & prioritization

- • Case creation, notes, evidence attachments and SLA tracking

- • Escalation rules, multi-stage workflows, audit trail and handoffs

6. Alerting & Notification

- • Push alerts to Slack, email, webhook sinks and internal dashboards

- • Escalation policies and on-call rotation integration

- • Notification templates for customers & partners (compliant messaging)

7. Risk Scoring & Decisioning

- • Composite risk score: rules + ML + manual signals

- • Decision engine for allow/challenge/block with TTL & hold queues

- • Soft-blocks & challenge flows (OTP, KYC, device verification)

8. Payments & Transaction Monitoring

- • Real-time transaction scoring & velocity checks

- • Refund & chargeback detection, merchant-level risk dashboards

- • Reconciliation support and automated dispute starter

9. Reporting & Analytics

- • KPI dashboards: fraud rate, precision/recall, time-to-close

- • Ad-hoc analytics & exportable CSV/PDF reports

- • Regulatory reporting packets & custom compliance exports

10. AI & Automation

- • Automated triage using severity classification

- • Auto-enrichers (device risk, OSINT checks, sanctions lists)

- • Chatbot assistant for first-level investigator actions

11. Security & Compliance

- • RBAC, SSO (SAML/OIDC) and strong session controls

- • Full audit logs, immutable evidence storage and chain-of-custody

- • Data masking, PII minimization and regional data residency options

12. Integrations & APIs

- • Outbound webhooks, REST APIs and SDKs for common platforms

- • Built-in connectors for payment gateways, KYC vendors, SMS/Email

- • Partner sandbox and contract testing for safe integration

13. Mobile & Web Access

- • Investigator web app: alert queue, case timeline, link explorer

- • Ops mobile app for urgent alerts and on-call responses

- • Admin console for rule management, deployments & model ops

Visuals

Gallery

Alert queue, case view, link graph, risk heatmap and model metrics.

Investigation Flow

Incident lifecycle — from alert to resolution

1) Alert generation

Rule or model raises an alert; enrichment (IP, geo, device) runs automatically.

2) Triage & prioritization

Score-based routing to analysts; high-risk alerts surface first with recommended actions.

3) Investigation

Investigator collects evidence, runs link-analysis and records notes & decisions.

4) Action & remediation

Block account, revert transaction, notify customer, or escalate to legal/collections.

5) Close & learn

Close case with outcome tags; feed labels back to model training set for continuous improvement.

Best practice: maintain a feedback loop from closed cases to labeled training data to reduce false positives over time.

Roles & Responsibilities

- • Analyst: triage & initial investigation

- • Investigator: deep-dive, evidence collection

- • Risk Ops: deploy rules, tune thresholds

- • ML Engineer: model lifecycle & drift monitoring